UAE secures $401mln, pioneering climate tech investment

2 min

UAE dominates MENA & Turkiye climate tech investment with $401M in funding.

Record $181M deal by Abu Dhabi's Pure Harvest highlights 2022's climate tech surge.

Horticulture attracts top sector funding of $288M; renewable energy leads in deal count.

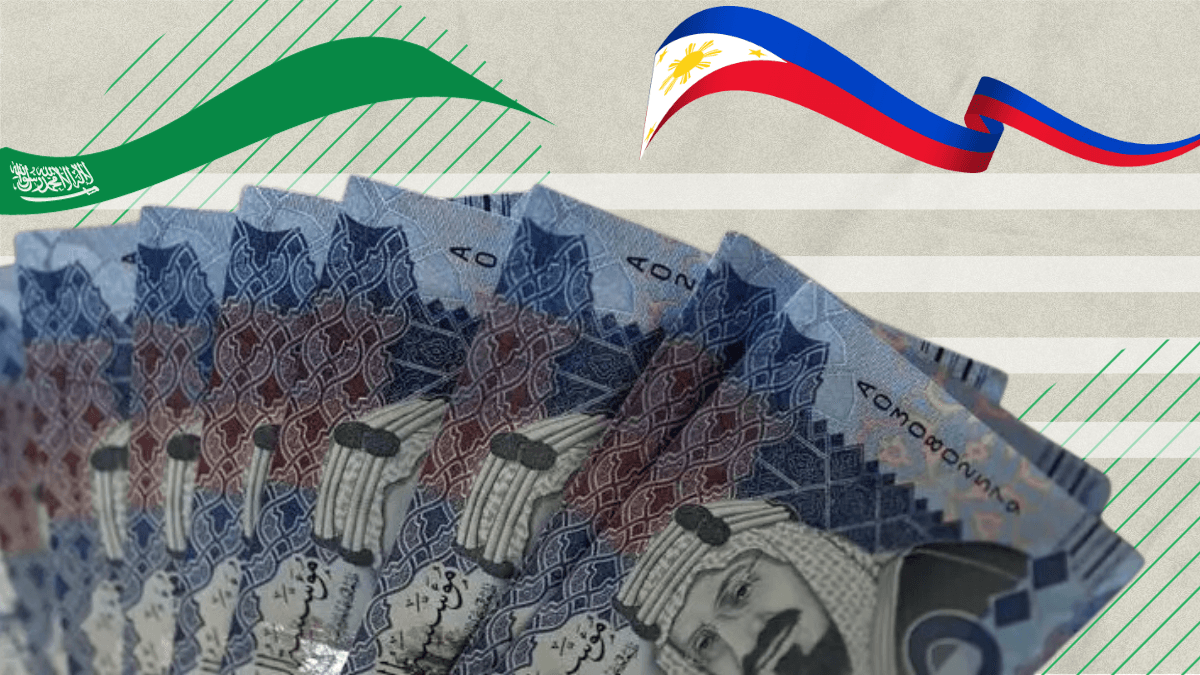

The United Arab Emirates has been recognized as the premier destination for climate tech investments in the Middle East and North Africa (MENA), and Turkiye. From 2018 to 2022, the UAE attracted $401 million, which constitutes 62% of the entire venture capital (VC) funding in the region, spanning 45 deals. This insight was highlighted in MAGNITT's recent "The State of Climate Tech" report.

Trailing the UAE were Turkiye and Saudi Arabia, securing $124 million and $68 million in climate tech investments, respectively. Meanwhile, Egypt and Tunisia secured the last two spots with $42 million and $6 million, respectively.

The report above underscored a notable uptrend in VC activity in the region over the past half-decade. Cumulatively, there's been $651 million in investments across 225 ventures. At present, climate tech represents 5% of all VC investments, marking an impressive 11-fold expansion since 2018.

An additional investment of $40 million in climate tech has been observed in the first half of 2023, aligning with the UAE's preparations to host the COP28.

Notably, 2022 was a banner year for climate tech investments in the MENA area, with a record $270 million in funding. Highlighting the year was a substantial $181 million convertible note deal by Abu Dhabi's Pure Harvest Smart Farms, which alone made up 67% of the annual funding.

In another significant transaction, Dubai-based Yellow Door Energy secured a $400 million PE buyout, with global investment powerhouse Actis taking the lead and backed by incumbent shareholders.

Sector-wise, horticulture emerged as the top draw, raking in $288 million, closely followed by renewable energy at $118 million. Renewable energy also led in the number of deals, with 39 transactions from 2018 to 2022, representing 17% of the total in the MENA and Turkiye areas. Agriculture followed suit with 55 sales in the same timeframe.

The biggest stories delivered to your inbox.

By clicking 'Register', you accept Arageek's Terms, Privacy Policy, and agree to receive our newsletter.

Comments

Contribute to the discussion